easyMarkets Turkey

EasyMarkets Turkey is a leading online trading platform providing traders access to various financial markets. These include Forex, commodities, indices, and stocks. The platform also offers a range of tools and features to help traders make informed decisions and maximize their profits. EasyMarkets Turkey is a reliable and secure platform regulated by the Turkish Capital Markets Board (CMB). With easyMarkets, traders can benefit from competitive spreads, low commissions, and fast execution. Additionally, the platform offers a range of educational resources and customer support to help traders get started and stay informed.

How to Get Started with easyMarkets in Turkey

If you want to get started with easyMarkets in Turkey and are new to trading, here’s what you need to do:

1. Open an Account: You can do this by visiting the easyMarkets website and clicking on the ‘Join Now’ button. You will then be asked to provide some personal information, such as your name, email address, and phone number.

2. Verify Your Account: You need to upload some identification documents, such as a passport or driving license to confirm your identity.

3. Fund Your Account: easyMarkets offers a range of deposit options, including credit/debit cards, bank transfers, and e-wallets. Choose the option that suits you best and follow the instructions to complete your deposit.

4. Choose Your Instrument: You can choose from a wide range of financial instruments to trade, including currencies, commodities, indices, and cryptocurrencies. Choose the one that you want to trade and start analyzing the market.

5. Place Your Order: When you are ready to place your order, select the financial instrument that you want to trade and choose your position size. You can then enter your stop-loss and take-profit levels to manage your risk.

6. Monitor Your Trade: Once your trade is open, you can monitor it using the easyMarkets platform. You can also set up alerts to notify you when certain market conditions are met.

Trading Assets

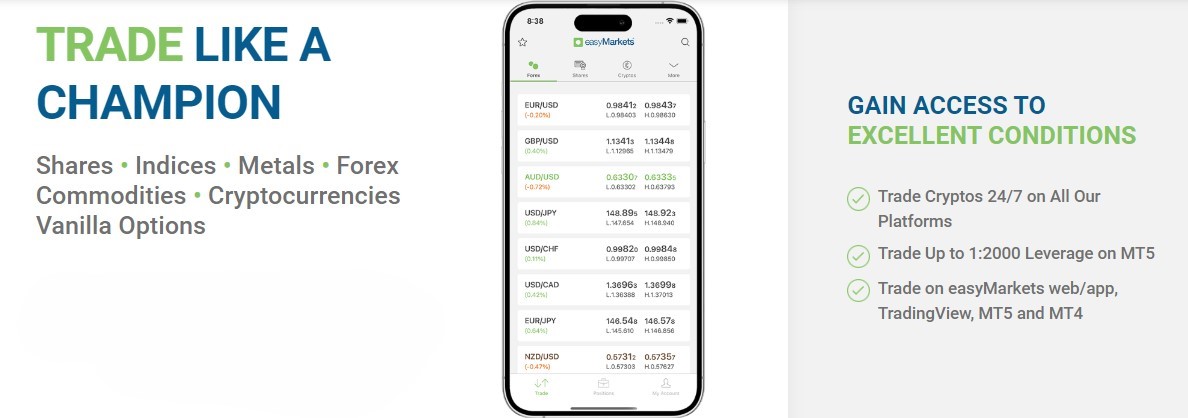

easyMarkets provides its clients with a wide range of trading assets, including Forex, shares, cryptocurrencies, metals, commodities, and indices, through its online trading platform.

Forex – or foreign exchange, is the world’s largest financial market that allows traders to buy and sell currencies. easyMarkets offers a range of currency pairs including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as exotic pairs like USD/RUB and EUR/TRY.

Shares – refer to the ownership of a company, and easyMarkets provides access to a range of global shares. These include popular companies like Apple, Microsoft, and Amazon.

Cryptocurrencies – EasyMarkets enables traders to buy and sell popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple.

Metals – such as gold and silver, have been used as a store of value for centuries, and easyMarkets provides traders with the opportunity to trade these precious metals. Other metals available for trading include platinum and palladium.

Commodities – Traders can trade a range of physical products on the market through easyMarkets. Including commodities like oil, natural gas, and agricultural products such as corn and wheat.

Indices – are a measure of the performance of a group of stocks or other assets. easyMarkets offers access to a range of global indices, including the S&P 500, NASDAQ, and FTSE 100.

easyMarkets Account Types

easyMarkets is a popular online trading platform that offers a variety of account types to suit the different needs and preferences of its users. Here, we will discuss the various types of accounts available on easyMarkets, along with their fees and features.

- Standard Account:

The most basic account type, which is perfect for beginners or those who want to start trading with a small amount of money. The minimum deposit required is $100. Users can trade in over 200 financial instruments, including currencies, commodities, and indices. It has no commission fees, but the spreads are slightly higher than other account types.

- VIP Account:

Experienced traders who are looking for advanced features and lower trading costs can sign up for a VIP account. To open a VIP account, users must deposit at least $2,500. Over 200 financial instruments, including currencies, commodities, and indices available. The account has lower spreads than the standard account, and users also get access to a personal account manager who can provide assistance and support.

- Premium Account:

The most advanced account type offered by easyMarkets. The minimum deposit required is $10,000. Users can trade in over 200 financial instruments, including currencies, commodities, and indices. The account has the lowest spreads of all the account types, and users also get access to a personal account manager who can provide assistance and support.

- Demo Account:

This account is designed for traders who are just starting out in the markets and who want to practice their trading strategies without risking any real money. The Demo Account offers a simulated trading environment with real-time market data and a range of trading tools and features.

easyMarkets Turkey’s Islamic Account

EasyMarkets Turkey offers Islamic accounts, which comply with Islamic religious principles. It is designed for traders who want to trade in accordance with their religious beliefs.

easyMarkets Turkey offers an Islamic account that does not charge or earn interest on overnight positions, making it a swap-free account. This is in line with Islamic religious principles, which prohibit the charging or earning of interest.

In addition, easyMarkets Turkey’s Islamic account does not charge any commissions or fees on trades. This is also in line with Islamic religious principles, which prohibit the charging of fees or commissions on trades.

The Islamic account also offers a range of other features, including tight spreads, fast execution, and a range of trading instruments. These features make it easy for traders to take advantage of market opportunities and maximize their profits.

Trading Platforms and Features

easyMarkets offers a variety of trading platforms for traders in Turkey, catering to their diverse needs.

easyMarkets platform caters to traders of all levels, from beginners to advanced traders. It features a user-friendly interface that makes it easy to use and navigate, making it an ideal choice for novice traders. Traders can access a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies, through the platform.

In addition to the easyMarkets platform, the broker also offers mobile apps for both iOS and Android devices. The mobile apps allow traders to access their accounts and trade on the go, giving them the flexibility to manage their trades from anywhere at any time.

For traders who prefer a more advanced trading platform, easyMarkets also provides access to TradingView. TradingView is a popular web-based platform that offers advanced charting tools, technical analysis, and real-time market data. It is a popular choice among traders who prefer to conduct their own technical analysis and make decisions based on market trends and patterns.

In addition to TradingView, easyMarkets also offers access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are highly popular among forex traders and offer advanced charting tools, automated trading options, and a range of trading indicators. MT4 is widely considered the industry standard for forex trading. The MT5 offers additional features such as more advanced order types and a wider range of financial instruments.

Trading Tools

easyMarkets Trading Tools are a suite of powerful features that enable traders to maximize their trading potential and minimize their risks.

- The easyTrade tool is a revolutionary trading product that allows traders to set their own risk level and potential payout before making a trade. This feature empowers traders to have complete control over their trading strategy and to minimize their exposure to market volatility.

- The dealCancellation feature allows traders to cancel a losing trade within a specified time frame, typically within an hour of opening the position. This powerful feature gives traders the ability to mitigate their risk and protect their capital in volatile markets.

- The Freeze Rate tool within the easyMarkets Trading Tools suite is another valuable feature. With Freeze Rate, traders can lock in a particular exchange rate for a specified period of time, typically up to three seconds. This tool gives traders the ability to reduce their exposure to market fluctuations and to take advantage of favorable exchange rates.

Trading Conditions

easyMarkets forex broker enhances the trading experience of its clients by providing a range of trading conditions.

- Negative Balance Protection – ensures that clients will never lose more than their account balance. This is particularly important in volatile markets, where sudden price movements can result in significant losses.

- Guaranteed Stop Loss – allows clients to set a predetermined level at which their position will be closed, regardless of market conditions. This provides a level of protection against sudden market movements or news announcements.

- No-slippage – this means that when you place a trade, you can be assured that you will get the exact price you see on the screen. This is a game-changer in the industry, as slippage can often lead to unexpected losses or missed opportunities. Perfect for those traders who want to take advantage of the volatile markets without the risk of slippage.

- Fixed Spreads – means that the difference between the bid and ask price remains constant, regardless of market conditions. This ensures that clients always know the cost of their trades upfront, and eliminates the risk of slippage. This can occur when the market moves rapidly and causes the execution price to deviate from the expected price.

Fees and Charges

easyMarkets Turkey offers competitive fees and commission rates for its clients. The fees and commission rates vary depending on the type of account and the type of trading instrument.

Forex

- no commission

- with spreads starting from 0.7 pips

CFDs

- commission rate is 0.08% of the trade value

- with spreads starting from 0.1 pips

Commodities

- commission rate is 0.08% of the trade value

- with spreads starting from 0.1 pips

Indices

- commission rate is 0.08% of the trade value

- with spreads starting from 0.1 pips

Stocks

- commission rate is 0.08% of the trade value

- with spreads starting from 0.1 pips

Options

- commission rate is 0.08% of the trade value

- with spreads starting from 0.1 pips

easyMarkets Deposit Methods in Turkey

easyMarkets broker is a popular online trading platform that allows users to trade in various financial markets. For users based in Turkey, easyMarkets provides different deposit methods to fund their accounts.

- Credit/Debit Card: Users can deposit money into their easyMarkets account using their credit or debit cards. This is one of the fastest and most convenient ways to fund an account.

- Bank Wire Transfer: Another method of deposit is through a bank wire transfer. This process may take longer than a credit or debit card deposit, but it is a reliable method.

- Online Payment Services: easyMarkets also accepts deposits from various online payment services. Some of these include Skrill, Neteller, FasaPay, WebMoney, and more.

- Cryptocurrency: Some easyMarkets platforms also allow users to deposit funds using cryptocurrencies like Bitcoin.

As for the easyMarkets minimum deposit amount, it usually depends on the type of trading account you are opening. Please note that these amounts and methods may vary and it’s always best to check the most current information on the easyMarkets website or by contacting their customer service.

easyMarkets Withdrawal Options in Turkey

easyMarkets online trading platform offers a variety of financial instruments including forex, shares, indices, commodities, and cryptocurrencies. If you are based in Turkey and wish to withdraw your funds from easyMarkets, you have several options.

- Credit/Debit Cards: You can withdraw your funds directly to your Visa, MasterCard, or Maestro card. The minimum withdrawal amount is $50, and the funds usually appear in your account within 3-10 business days.

- Bank Transfer: You can also opt for a bank transfer directly to your local bank account. The minimum withdrawal amount for bank transfers is $100, and it may take 3-5 business days for the funds to reflect in your account.

- E-Wallets: easyMarkets also supports various e-wallets like Skrill, Neteller, and WebMoney. The minimum withdrawal amount for e-wallets is usually $50, and the funds are typically available within 24-48 hours.

- FasaPay: For users in Turkey, FasaPay is also an option. The minimum withdrawal amount is $50, and funds are usually available within 24 hours.

Please note that the exact easyMarkets minimum withdrawal amounts may vary based on your account type and other factors. It’s always recommended to check the latest information on the easyMarkets website or contact their customer support for personalized assistance.

Also, keep in mind that easyMarkets may charge a small fee for withdrawals, and your bank or e-wallet provider may also charge a fee for processing the transaction. Always check the terms and conditions before making a withdrawal to avoid any unexpected charges.

Education

In terms of educational resources, easyMarkets offers a range of materials to help traders learn the basics of trading and develop their skills. These include webinars, tutorials, eBooks, and video courses. The webinars cover topics such as risk management, technical analysis, and trading strategies. The tutorials provide step-by-step guidance on how to use the easyMarkets platform, while the eBooks and video courses offer more in-depth information on trading topics.

Customer Support

easyMarkets also provides a range of customer service channels. These include a live chat service, email support, and a telephone helpline. The live chat service is available 24/7 and provides customers with instant access to a customer service representative. The email support team is available to answer any questions or queries customers may have, while the telephone helpline is available during business hours.

easyMarkets Turkey Pros & Cons

Pros:

Let’s explore the advantages and disadvantages of trading with the easyMarkets platform.

One of the primary benefits of trading with easyMarkets Turkey is the low cost of entry. This platform offers competitive spreads and low commissions. Making it an attractive option for traders who are just starting out.

Additionally, easyMarkets Turkey offers a variety of trading tools and features, such as charting tools, market analysis, and automated trading systems.

Another advantage of trading with easyMarkets Turkey is the security of the platform. This platform is regulated by the Turkish Capital Markets Board (CMB). This ensures that all transactions are secure and transparent.

Additionally, easyMarkets Turkey offers a variety of risk management tools, such as stop-loss orders and margin calls. These tools can help traders protect their investments.

Cons:

Market volatility is one of the primary risks on easyMarkets. Traders should be aware of the risks associated with trading in volatile markets as there is always the potential for losses, just like any investment.

Additionally, easyMarkets Turkey has limited customer support, so traders may have difficulty getting assistance if they encounter any issues.

Is easyMarkets Legal in Turkey?

Yes, easyMarkets Turkey is a legal forex broker. The company is regulated by the Capital Markets Board of Turkey (CMB) and is a member of the Istanbul Stock Exchange (ISE). easyMarkets Turkey is also a member of the Investor Compensation Fund (ICF), which provides protection to clients in the event of a broker’s insolvency.

Is easyMarkets Halal in Islam?

In terms of whether easyMarkets is halal in Islam, it depends on the specific products and services offered by the broker. While the company claims to be a halal broker and offers Islamic accounts for Muslim traders, it is important for individuals to do their own research and due diligence before investing.

easyMarkets Review Turkey – Conclusion

In conclusion, easyMarkets Turkey is a great choice for anyone looking to trade in the Turkish market. With its low spreads, fast execution, and wide range of trading instruments, it is an ideal platform for both experienced and novice traders. The customer service team is also highly knowledgeable and responsive, making it easy to get help when needed. With its competitive fees and reliable trading environment, easyMarkets Turkey is a great choice for anyone looking to trade in the Turkish market.

Check out these other recommended legitimate forex brokers in Turkey.